Education Newsletter: Trading and Watchlist Setup Discussion

Disclaimer: Intraday Chart Links will show up as daily charts unless you have an active stockcharts.com membership and are signed in, you can sign up here.

1

Quick Discussion:

In this newsletter, I will share some thoughts on how to better prepare for trading. Specifically, I will illustrate a simple process if you are considering acting upon our trade ideas or some other setups that you find interesting. We do our best to find valid setups but that is just the beginning. You must take some time to organize and prepare for the next trading day.

As you know, we have provided several trading tips via tutorials and educational discussion (examples) in the newsletter and on the trading community to incorporate into your trading. However, you must develop a trading style or methodology that corresponds to your objectives that is effective (that works). Further, you success rate will improve with experience (learning from past mistakes and making such adjustments).

You must put some time in on your own if you expect to succeed. Do not solely rely upon others to tell you what to buy or sell without a clear understanding. Successful trading/investing takes some time and effort and will improve with experience.

"Fail to Plan - Plan to Fail"

Best wishes,

Steve

2

Nightly Trade Preparation:

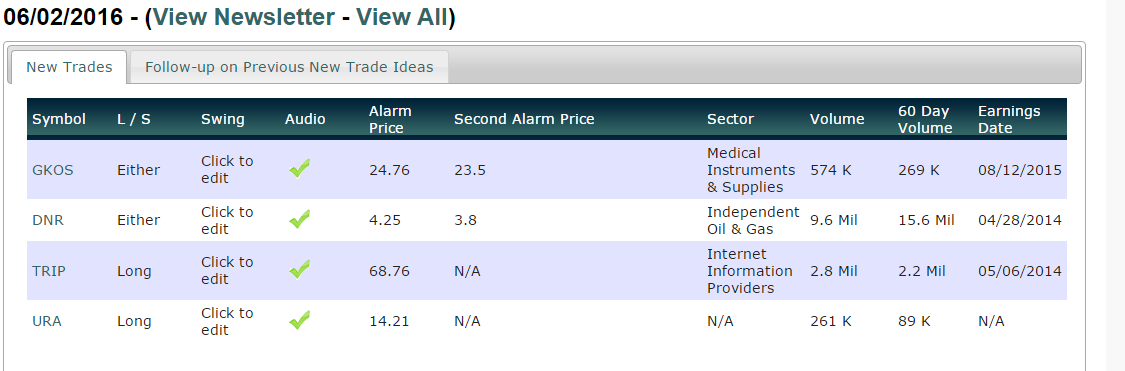

1. Listen to the Newsletter and Review the New Trade Ideas Each Night (and examine older setups that remain valid). Do you best to prioritize your setups in accordance with YOUR preferences.

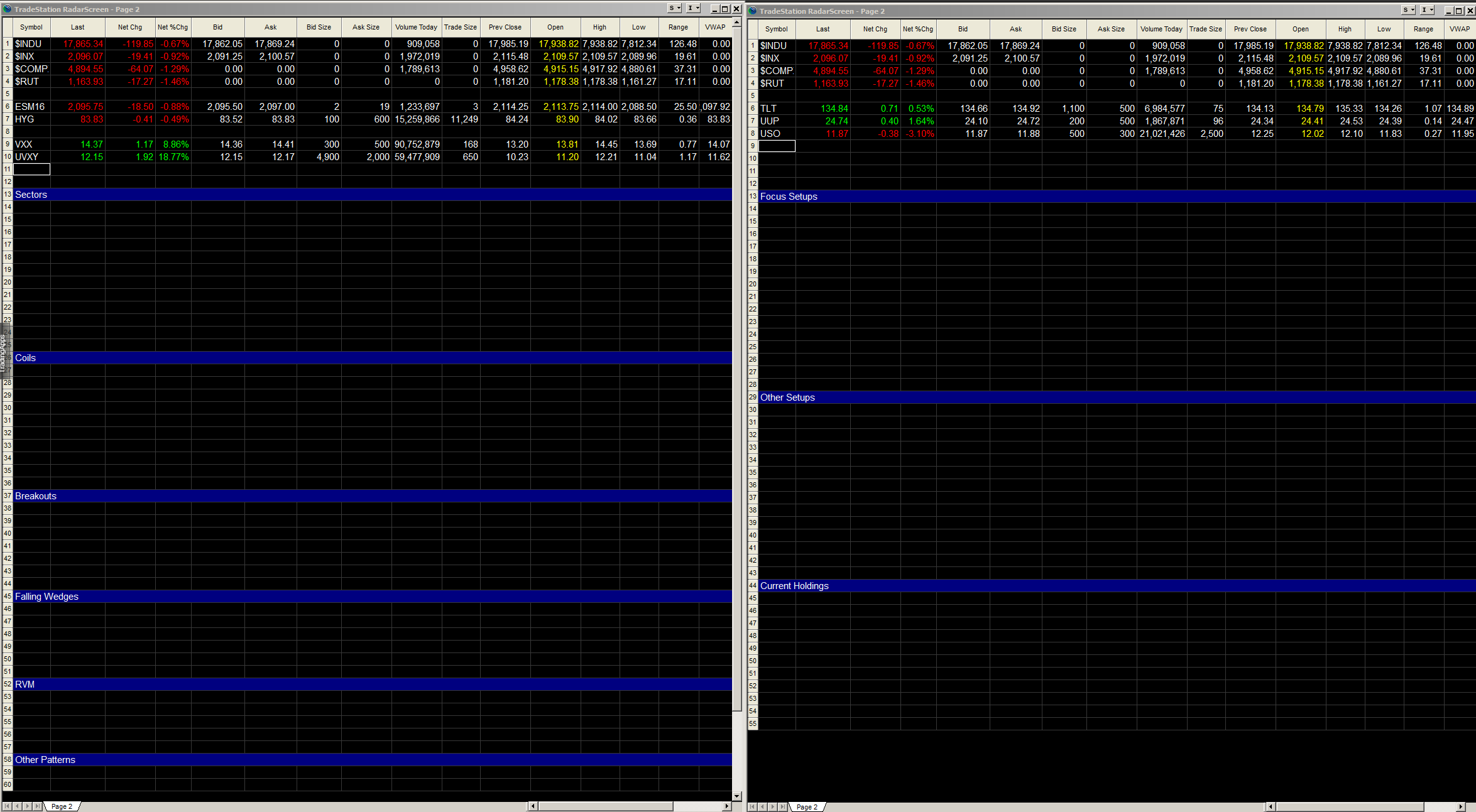

2. Select 5-10 as Focus Stocks on Your Watchlist (you can add a secondary list below your focus setups). I tend to prefer coiling setups or wedges but will play various setups at times.

3. Organize you trade ideas on Watchlist and set appropriate alarms if needed.

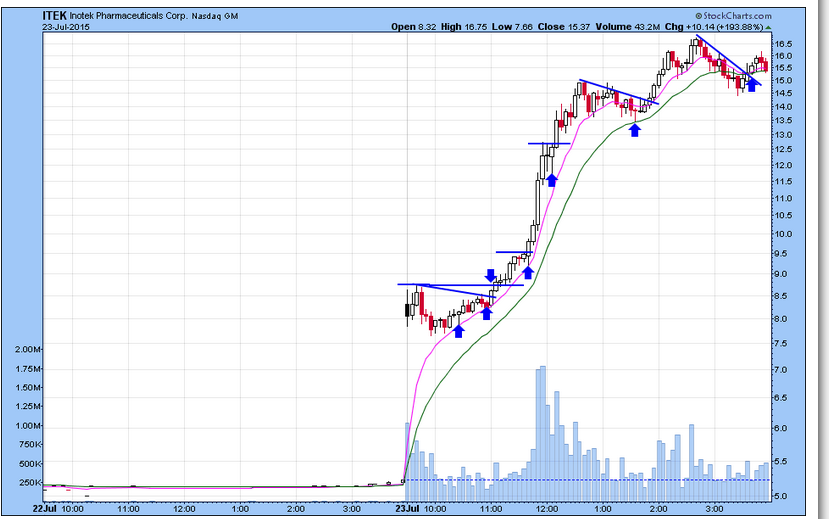

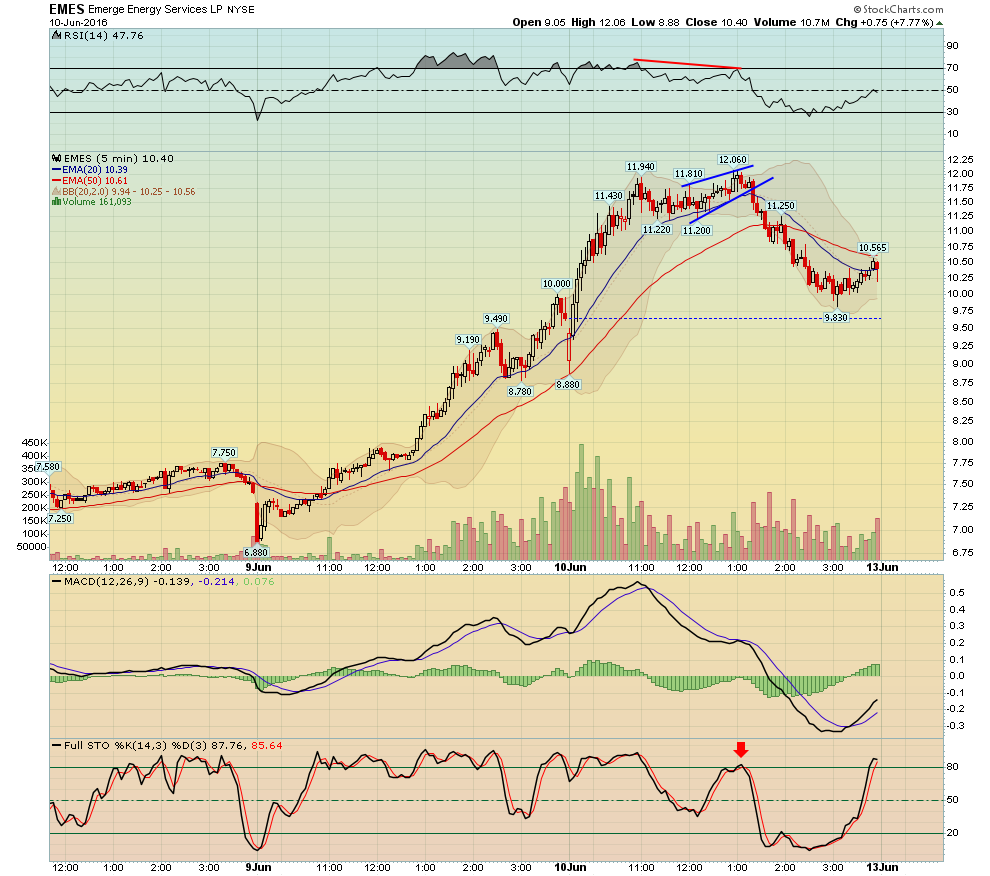

4. Examine the intraday charts of the stocks you like for additional evidence/patterns or lower risk entries. Attempt to do this every night PRIOR to the start of trading.

5. In addition, listen to our thoughts on the broad market and any sectors that may stand out from the nightly newsletter. I prefer to play with the trend that day. I want to know what sectors are strong/weak that may impact some of my setups. For example, if the market is very extended, I may look to take profits quicker on longs.

6. Once you trigger (long or short) set an appropriate stop based upon the time frame you are trading.

7. If possible, manage your existing trades by shifting down to smaller time frames during the trading session.

8. After a decent move unfolds (percentage will vary by what you're trading) consider raising stops and/or taking some profits.

9. After the close, review your current positions and make necessary adjustments to stops and profit targets.

10. Repeat all steps everyday.

3

4

5

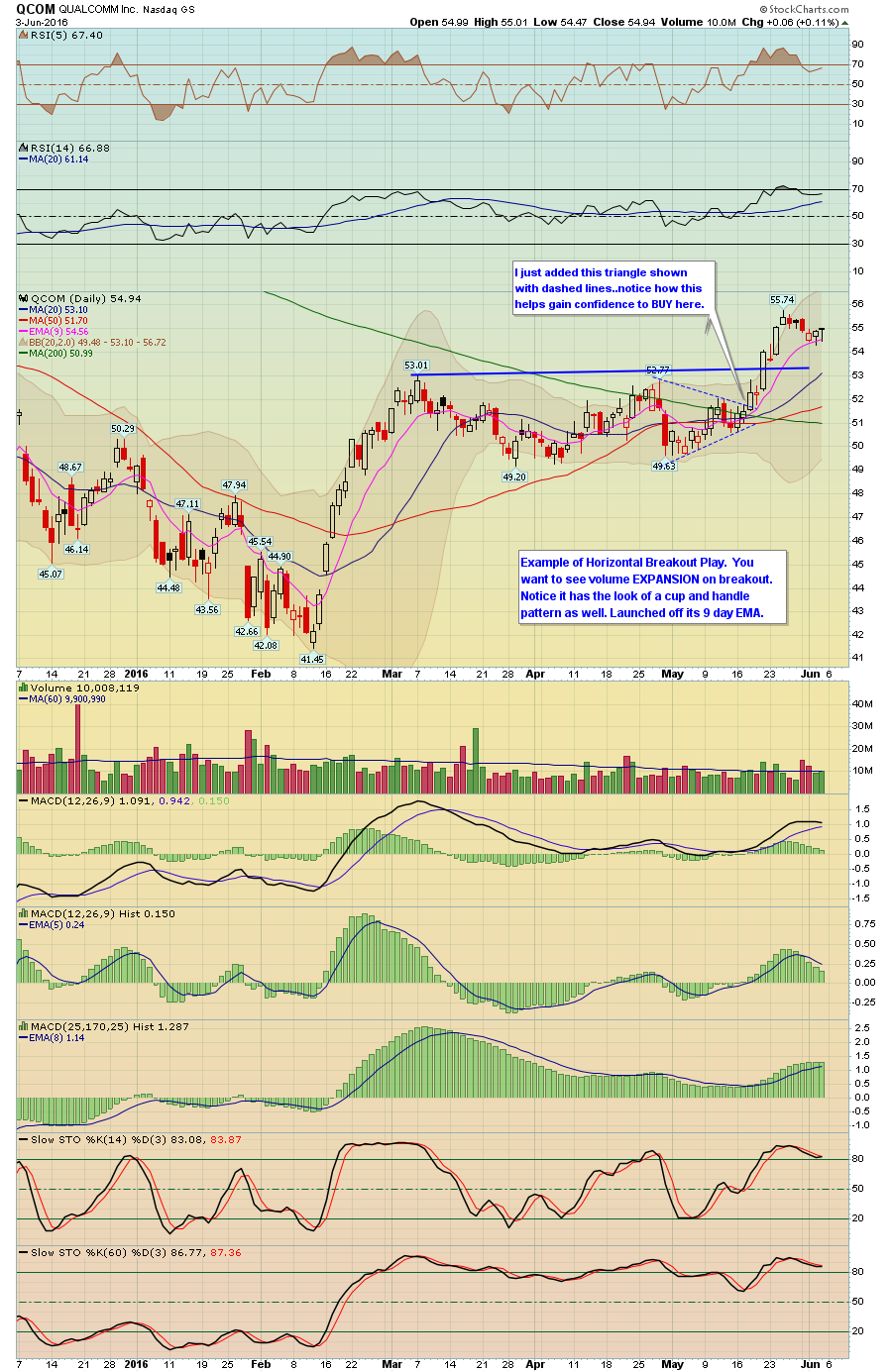

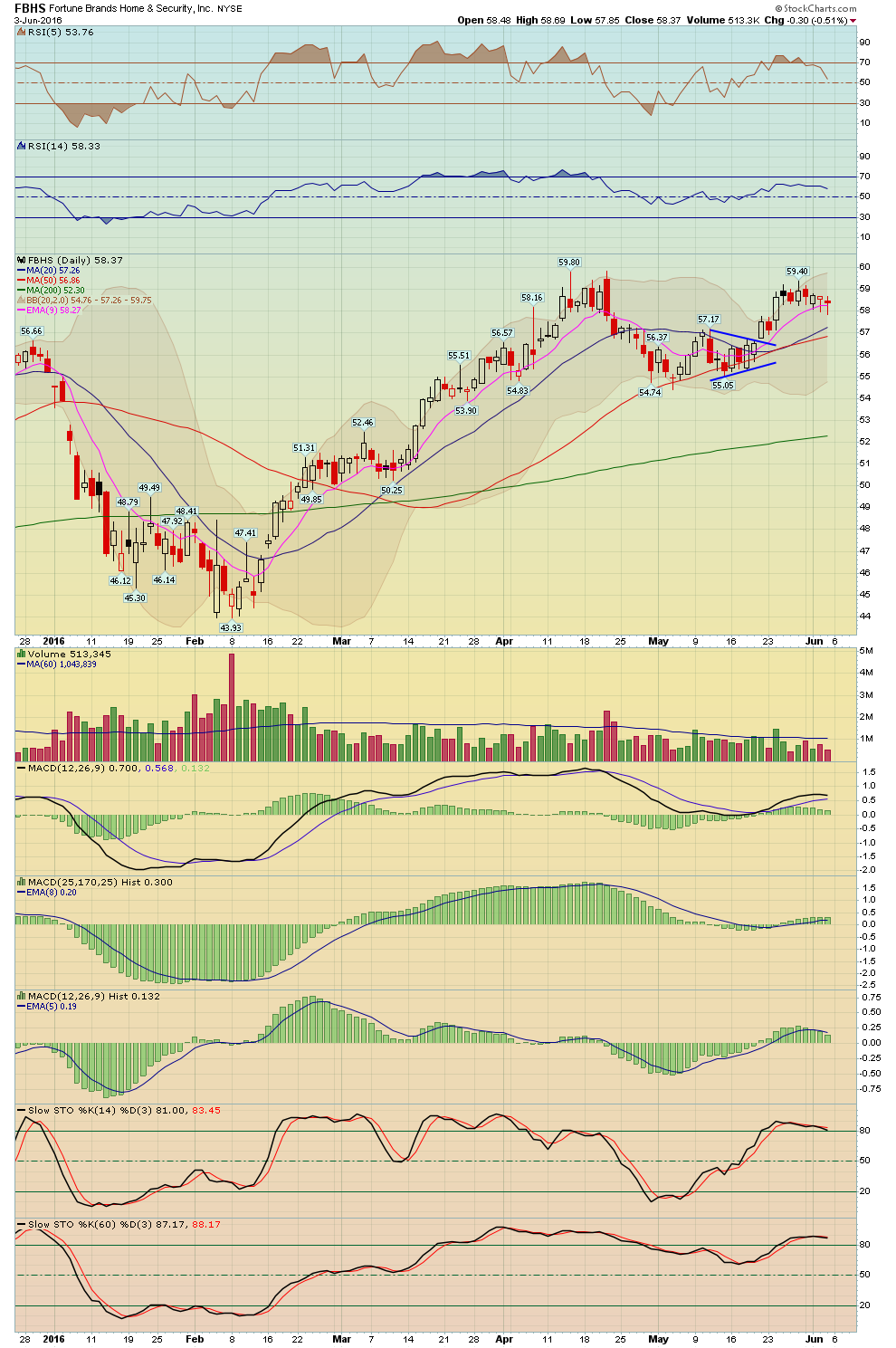

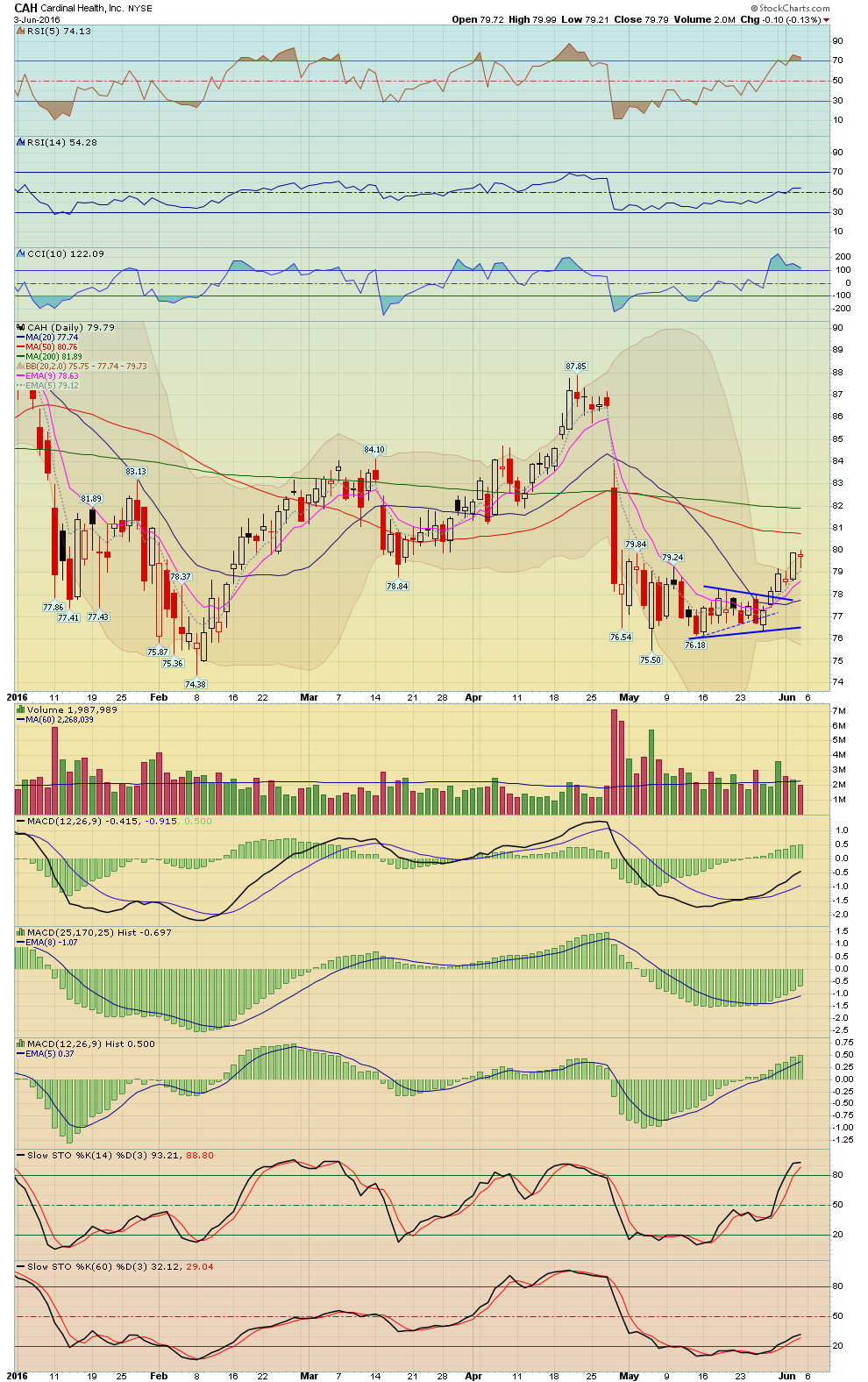

BREAKOUT SETUPS

6 - View Live Chart

7 - View Live Chart

8 - View Live Chart

9

FALLING WEGDE SETUPS

10 - View Live Chart

11

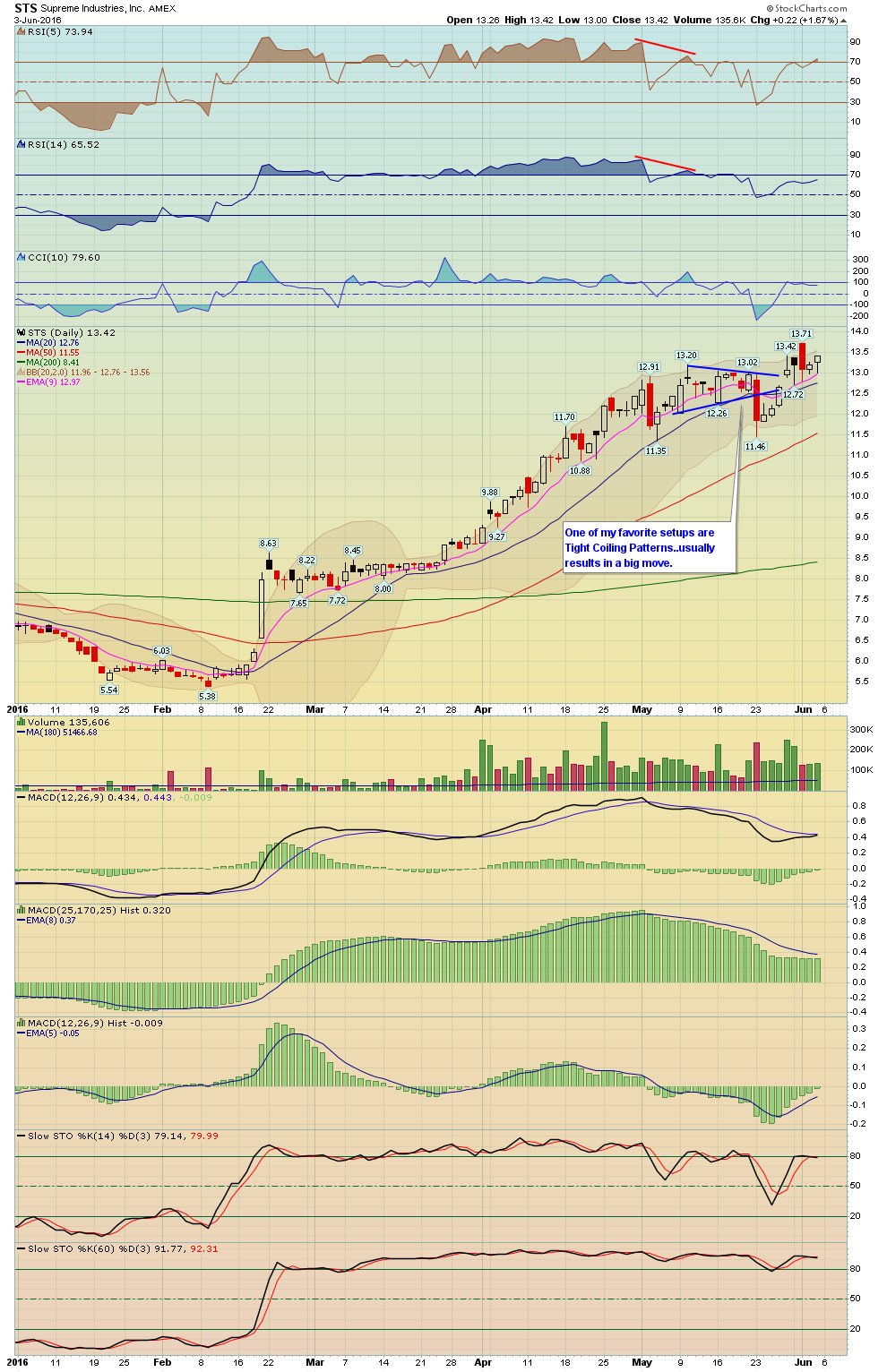

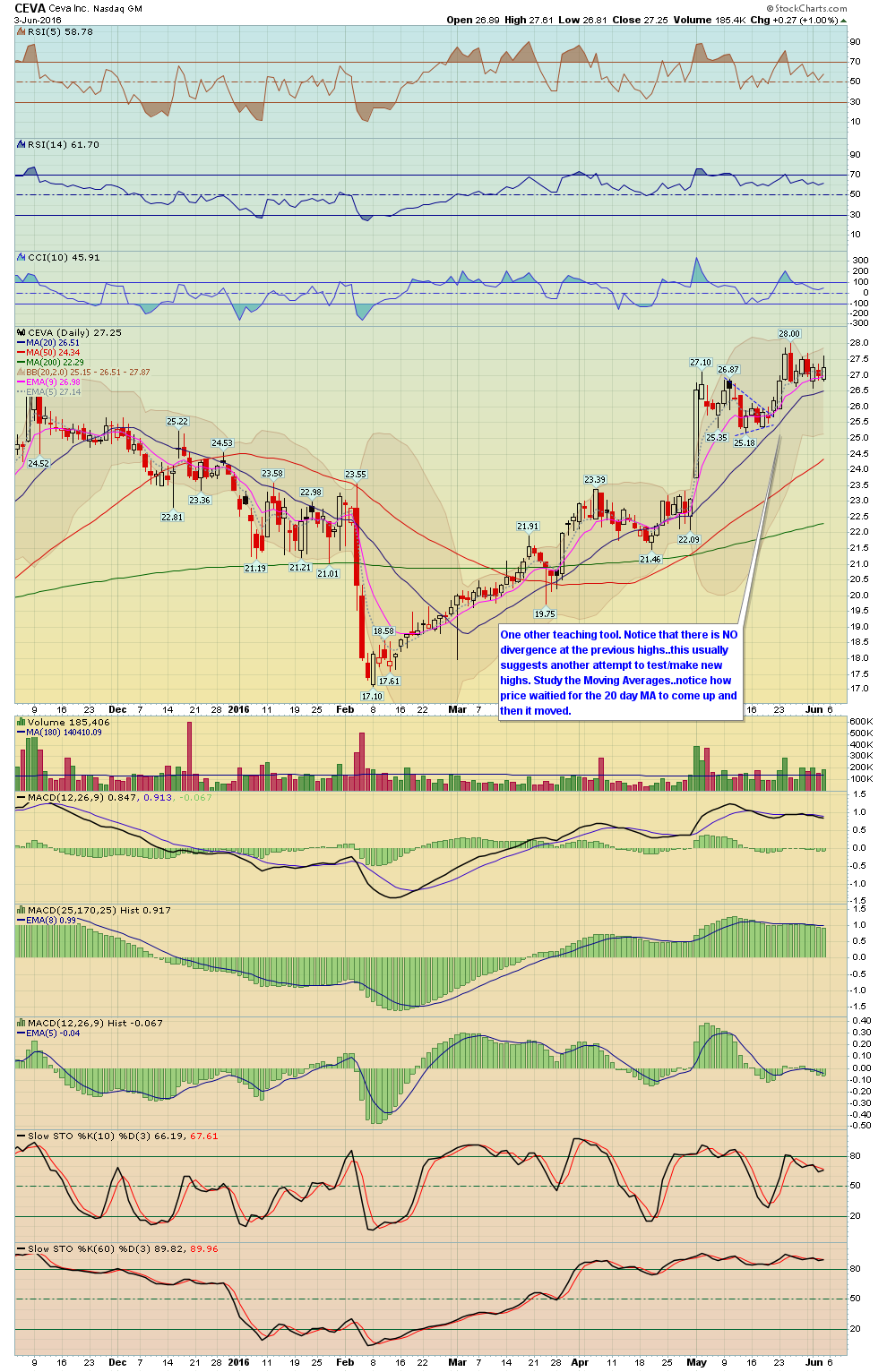

COILING SEUTPS

12 - View Live Chart

13 - View Live Chart

14 - View Live Chart

15 - View Live Chart

16 - View Live Chart

17 - View Live Chart

18 - View Live Chart

19

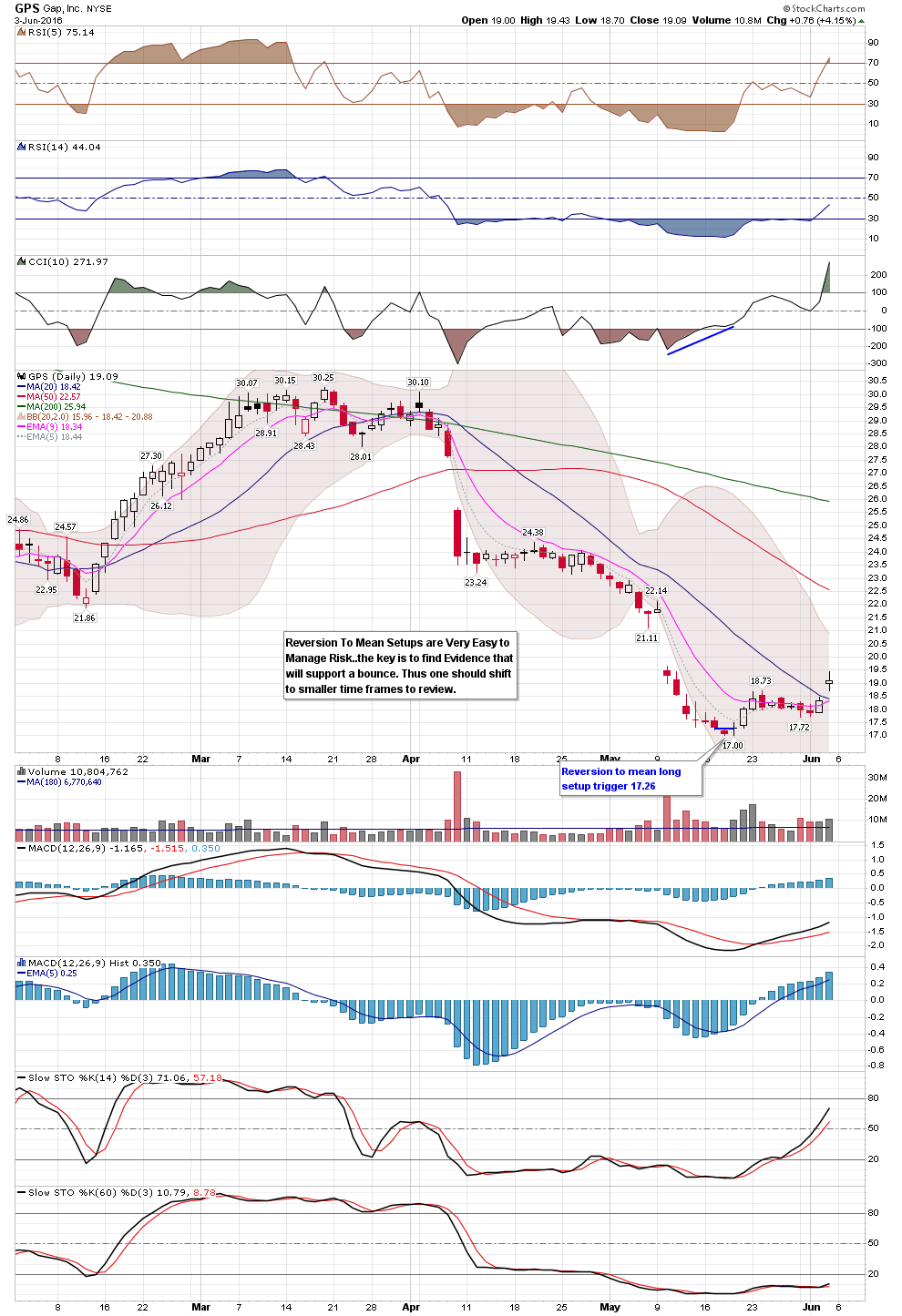

RVM (Reversion to Mean) SETUPS

20 - View Live Chart

21

BOTTOM SETUPS

22 - View Live Chart

23

24 - View Live Chart

- Hide Player Link to Newsletter Audio

- Hide Player Link to Newsletter Audio

- Hide Player Link to Newsletter Audio

- Hide Player Link to Newsletter Audio

- Hide Player Link to Newsletter Audio

- Hide Player Link to Newsletter Audio

- Hide Player Link to Newsletter Audio